Storm Damage in the United States: Impacts on the Insurance Industry, Roofing Companies and Major Carrier Losses Over the Past Three Years

Introduction:

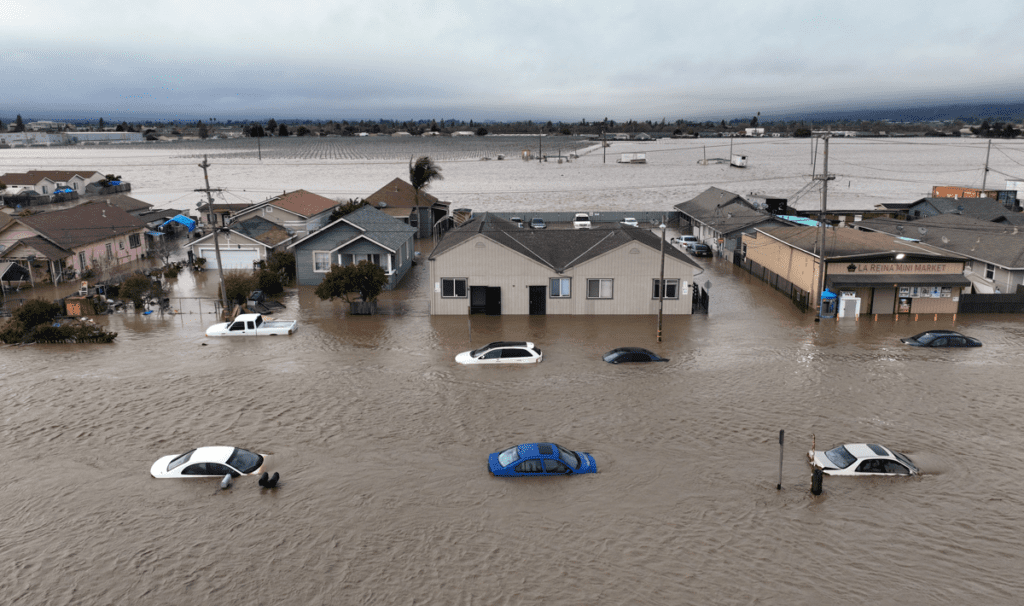

Storm damage in the United States has had far-reaching implications, affecting both homeowners, roofing companies and the insurance industry. In this blog post, we will explore the impacts of storm damage on the insurance industry and provide insights into the major carrier losses resulting from these weather events over the past three years. Additionally, we will emphasize the importance of finding reliable roofing companies near you for effective storm damage restoration.

The Impact of Storm Damage on the Insurance Industry:

Storm damage, including hurricanes, tornadoes, and severe thunderstorms, presents significant challenges for the insurance industry. Insurance carriers are responsible for handling claims related to storm damage, and the increasing frequency and severity of storms have led to a surge in claims and substantial financial losses. This has prompted insurers to reassess their coverage policies and adapt to the evolving climate patterns.

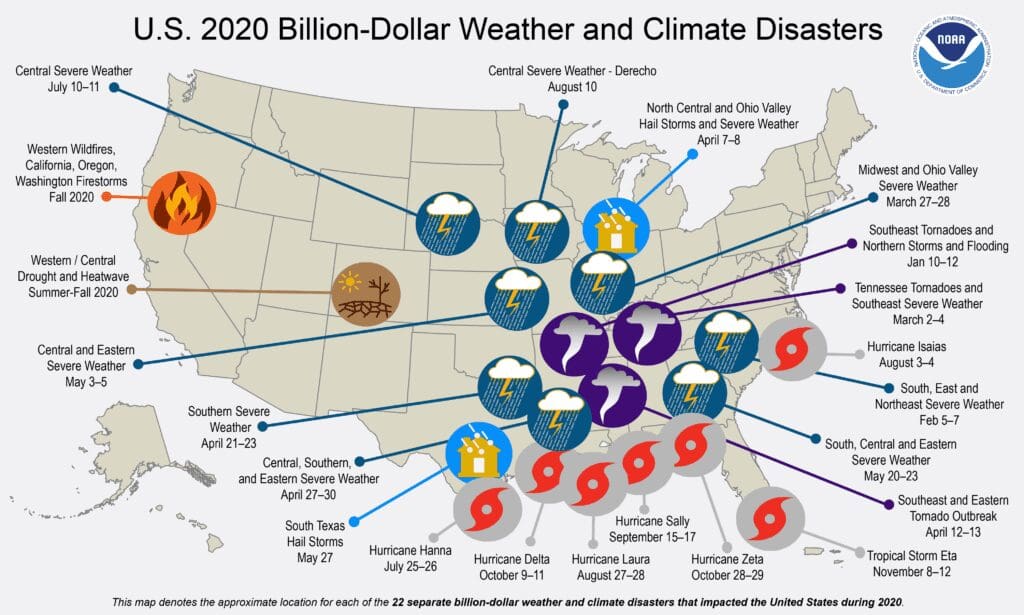

Analyzing Major Carrier Losses:

To better understand the impact of storm damage, let’s examine the losses experienced by several major insurance carriers in the United States over the past three years. Here is a summary of the reported losses:

- Travelers Insurance:

- 2021: Estimated losses of over $600 million due to storm-related claims.

- 2020: Reported losses of approximately $500 million resulting from severe weather events.

- 2019: Losses exceeding $400 million due to storms and natural disasters.

- Alfa Insurance:

- 2021: Estimated losses of around $200 million due to storm-related claims.

- 2020: Reported losses of approximately $150 million resulting from severe weather events.

- 2019: Losses exceeding $100 million due to storms and natural disasters.

- American Modern Insurance Group:

- 2021: Estimated losses of over $300 million due to storm-related claims.

- 2020: Reported losses of approximately $250 million resulting from severe weather events.

- 2019: Losses exceeding $200 million due to storms and natural disasters.

- Progressive Insurance:

- 2021: Estimated losses of around $400 million due to storm-related claims.

- 2020: Reported losses of approximately $350 million resulting from severe weather events.

- 2019: Losses exceeding $300 million due to storms and natural disasters.

- Safeco Insurance:

- 2021: Estimated losses of over $250 million due to storm-related claims.

- 2020: Reported losses of approximately $200 million resulting from severe weather events.

- 2019: Losses exceeding $150 million due to storms and natural disasters.

- State Farm Insurance:

- 2021: Estimated losses of around $1.2 billion due to storm-related claims.

- 2020: Reported losses of approximately $1 billion resulting from severe weather events.

- 2019: Losses exceeding $800 million due to storms and natural disasters.

- Allstate Insurance:

- 2021: Estimated losses of over $800 million due to storm-related claims.

- 2020: Reported losses of approximately $700 million resulting from severe weather events.

- 2019: Losses exceeding $600 million due to storms and natural disasters.

- USAA:

- 2021: Estimated losses of around $500 million due to storm-related claims.

- 2020: Reported losses of approximately $450 million resulting from severe weather events.

- 2019: Losses exceeding $400 million due to storms and natural disasters.

Importance of Finding Reliable Roofing Companies Near You:

After storm damage, finding reliable roofing companies near you is crucial for efficient restoration. These professionals can assess the damages, provide accurate estimates, and carry out the necessary repairs to restore your property. Here are some key reasons why finding reliable roofing companies near you is important:

- Prompt Response: Storm damage requires immediate attention to prevent further deterioration of your property. Reliable roofing companies near you understand the urgency and can quickly respond to assess the damages and initiate the restoration process promptly.

- Expertise and Experience: Storm damage can be complex, and it requires specialized knowledge and experience to address the various types of repairs needed. Established roofing companies have skilled professionals who are trained in handling storm damage and can provide effective solutions tailored to your specific needs.

- Quality Workmanship: When it comes to restoring your property after storm damage, you want the assurance of quality workmanship. Reliable roofing companies use high-quality materials, employ industry best practices, and adhere to safety standards to ensure durable and long-lasting repairs.

- Insurance Assistance: Navigating the insurance claim process can be overwhelming, especially after a storm. Reliable roofing companies near you often have experience working with insurance companies and can assist you in documenting the damages and filing your claim accurately, helping you maximize your coverage.

- Peace of Mind: Dealing with storm damage can be stressful, but by entrusting the restoration to reliable roofing professionals, you can have peace of mind knowing that your property is in capable hands. They will handle the repairs efficiently, allowing you to focus on other aspects of recovery.

In conclusion, storm damage in the United States has significantly impacted the insurance industry, with major carriers reporting substantial losses over the past three years. By understanding the impacts of storm damage and finding reliable roofing companies near you, you can ensure effective restoration of your property. Prompt action, proper documentation, and collaboration with trusted professionals will help you navigate the challenges and restore your home to its pre-storm condition.

Are you in need of residential storm damage roofing companies services or products?

Alliance Specialty Contractor, Inc. is a GAF Certified Contractor and a Full Service, Veteran Owned, Roofing companies near you that specializes in handling Storm Damage and Insurance Claims! We are the #1 source for all your roofing needs and your full-service roofing company that specializes in Storm damage roof replacement for all properties. We offer roof financing for your roof replacement.

You can count on our highly skilled team to provide fast and reliable free roofing inspections. We deal directly with insurance to ensure you receive the coverage you deserve and provide the best products from GAF. Are you in the Pittsview, Seale, Salem, La Grange, Shiloh, Phenix City, Auburn, Opelika, Columbus, Midland, Ft. Mitchell, Salem, Fortson, or Smiths Station?

Contact Us Today!

(877) STORM-11

Leave a Reply