Are You Getting What You Should On Your Roofing Companies Insurance Claim?

FACT: Your Insurance Company Interests Are NOT The Same As Your Interests

If your roof has sustained damage from hail, wind, or other storm damage, your homeowner insurance should cover the costs (less your deductible) to restore the roof to where it was before the damage.

At least that’s how it should work in theory.

In practice, it doesn’t always work out that way. The basic problem is that your insurance company has an interest in keeping their costs as low as possible (they are a for-profit business, after all). And their biggest costs are paying out insurance claims to roofing companies.

So, it’s just a FACT: your insurance company’s interests and your interests aren’t completely aligned. You want the full and necessary amount to restore your roof to where it was prior to the storm. Your insurance company wants to control costs.

Are we saying that insurance companies are only out to cheat you?

No, that wouldn’t be fair. But we are saying that you need to go into the process with your eyes wide open. No matter how much you like your insurance agent, your agent won’t be the insurance claims adjuster. The process is complicated, and the insurance company knows the “ins and outs” of the process a lot better than homeowners.

What You Need Is A True Professional For YOUR Interests

A homeowners insurance claim is a request for financial compensation from an insurance company for damage to a home or other property. Homeowners insurance policies cover a wide range of perils, including natural disasters such as storms, fires, and earthquakes, as well as man-made events such as vandalism and theft.

The process of filing a homeowners insurance claim typically begins when the homeowner contacts their insurance company to report the damage. The insurance company will then send an adjuster to assess the damage and determine the cost of the repairs. The adjuster will review the terms of the insurance policy and determine whether the damage is covered under the policy.

Once the adjuster has completed their assessment, the homeowner will receive an estimate of the cost of the repairs and an explanation of the coverage provided by the policy. The homeowner can then decide whether to proceed with the repairs or to file an insurance claim with the insurance company.

If the homeowner decides to file a claim, they will need to provide documentation of the damage, such as photos, receipts for temporary repairs, and estimates for permanent repairs. The insurance company will review the claim and, if it is approved, will issue a payment to the homeowner to cover the cost of the repairs.

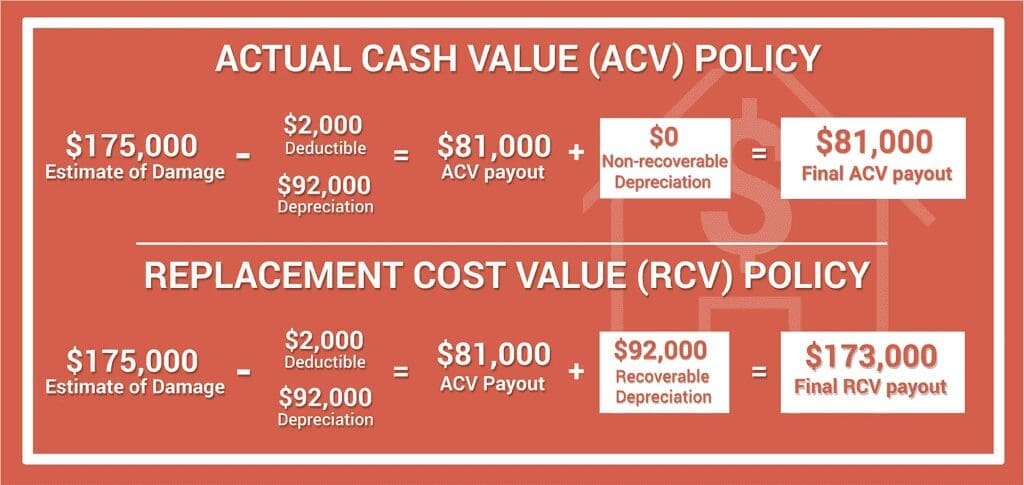

The amount of the payment will depend on the terms of the insurance policy and the extent of the damage. Some policies may have a deductible, which is an amount that the homeowner must pay out of pocket before the insurance company will cover the remaining cost of the repairs.

In some cases, the insurance company may dispute the claim or deny it entirely. This can occur if the damage is not covered by the policy, if the policy has lapsed, or if the insurance company believes that the damage was not covered by the policy. If this happens, the homeowner can appeal the decision or seek the assistance of a homeowners insurance claims expert to negotiate a settlement.

In summary, a homeowners insurance claim is a request for financial compensation from an insurance company for damage to a home or other property. It is important for homeowners to have a clear understanding of their insurance coverage and to document the damage thoroughly in order to ensure that their claim is processed smoothly and fairly. If the insurance company disputes or denies the claim, homeowners may need to seek the assistance of a homeowners insurance claims expert to help them navigate the claims process and negotiate a settlement.

- There are several reasons why homeowners may want to file a homeowners insurance claim. Here are some common reasons why homeowners file insurance claims:

- To cover the cost of repairs: Homeowners insurance policies provide financial protection in the event of damage to a home or other property. By filing a claim, homeowners can receive compensation to cover the cost of repairs or replacements.

- To protect against financial loss: Damage to a home or other property can be costly, especially if it is extensive or if it involves expensive items like appliances, furniture, or electronics. Filing a homeowners insurance claim can help homeowners recoup some of these losses and protect against financial hardship.

- To ensure that repairs are done properly: Homeowners insurance policies often require that repairs be done by licensed professionals, which can provide homeowners with an added level of protection and ensure that the repairs are done correctly.

- To take advantage of policy benefits: Many homeowners insurance policies offer additional benefits, such as temporary housing or loss-of-use coverage, which can help homeowners cover the cost of living expenses if their home becomes uninhabitable due to damage. By filing a claim, homeowners can access these benefits and get the support they need during a difficult time.

- To fulfill policy requirements: Homeowners insurance policies often have requirements that homeowners must meet in order to receive coverage. For example, homeowners may be required to report damage within a certain timeframe or to take steps to prevent further damage. By filing a claim, homeowners can ensure that they are meeting these requirements and maintaining the coverage provided by their policy.

In summary, homeowners may file a homeowners insurance claim to cover the cost of repairs, protect against financial loss, ensure that repairs are done properly, take advantage of policy benefits, and fulfill policy requirements. It is important for homeowners to understand their insurance coverage and to file a claim promptly after damage occurs to ensure that they receive the full protection and benefits provided by their policy.

Filing a roof insurance claim on your own would be a lot like going into a courtroom without a lawyer. You don’t know the rules, you don’t know the right questions to ask, and the other side is going to use all that to their advantage.

Even worse, this “courtroom” is one where the insurance adjuster also serves as judge and jury, too. If they say, “claim denied” or “this is the small amount you get,” you have little recourse if you don’t understand how the process works.

The bottom line is that this is a cumbersome, confusing process and you should have someone help you. Your local roofing companies, fortheclaim.com can help you through this process to make sure you get every penny you’re entitled to under the terms of your homeowner’s insurance policy.

For more about why we’re specially qualified as a roofing companies to help you through this process, please visit our Roof Insurance Experts page.

We assist homeowners who need help navigating the roof insurance claims process. We do it fairly, legally, and with great attention to detail. Contact fortheclaim.com if you think your roof has suffered damage from hail, wind, or other storm damage.

Is Your Insurance Claims Adjuster Experienced Enough?

One thing we’ve seen far too often are roof insurance claims adjusters who don’t know nearly enough about roofing companies. That might sound crazy, but it happens more than you’d think.

Examples of some of the things we’ve seen:

- Adjusters confusing hail damage (which is covered by insurance) with “blistering” (which is heat damage caused by a poorly ventilated roofing companies system and not covered by insurance). If the adjuster gets this wrong, your claim will be denied.

- After big storms, insurance companies will sometimes use adjusters from other areas of the company – adjusters with absolutely no roofing companies experience – to handle the rush of claims.

- Roof claims adjusters not being able to confidently tell the difference between normal wear and tear (not covered) from true storm damage (covered).

We even had one memorable experience where we met an adjuster in the field on his very first day. He was not properly trained, had no other adjuster there to teach him, and he barely knew how to get up the ladder!

Now ask yourself… if any of these things happened with your claim, do you think you’ll get a fair shake without someone experienced looking out for you?

Contact fortheclaim.com if you think your roof has suffered damage from hail, wind, or other storm damage.

… And One Last Thing To Watch Out For

We do need to warn homeowners about one other issue with roof insurance claims.

While we do think you should always have a roofing companies help you through this process, you do need to be very careful about which advocate you choose. Not all of roofing companies are experts on insurance claims and not all of them maintain the highest standards of integrity.

Here are some red flags to watch out for:

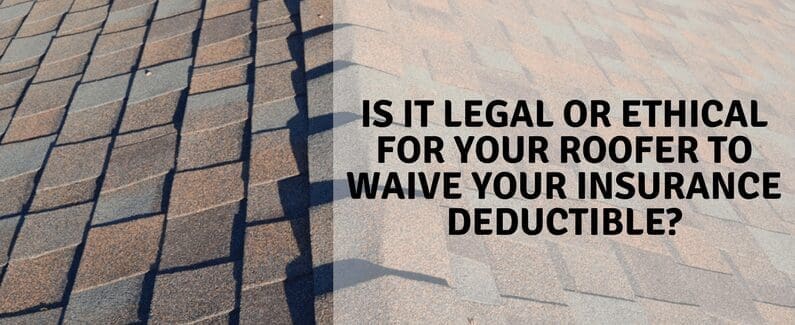

- Any roofing companies that offers to get you a “free roof” or says, “they’ll help you out with the deductible” (this is insurance fraud).

- Any roofing companies that “storm chases” from town to town or goes knocking on doors offering to file a roofing insurance claim – all before even knowing anything about your roof.

- Roofing companies without proper credentials and proof of reputation. (Do they have lots of 5-star Google reviews? Are they A+ Rated with the Better Business Bureau? Do they have their own team of Project Managers or do they sub-contract everything?).

Choose wisely, and you’ll get every penny you need to restore your roof; choose poorly and you’ll have headaches and a roof that is never made whole.

Contact fortheclaim.com if you think your roof has suffered damage from hail, wind, or other storm damage.

Things You Should Know About Roofing Companies Claims

Roofing is a very important part of your home. It covers and protects your home from rain, snow and other weather conditions. If your roof is damaged or not well maintained, it can result in damage to your house. When this happens, you may have to pay roofing companies for repair costs that can be expensive.

If you’re like many people, you may have recently searched for phrases like “roofing companies near me” or “roofing near me” in order to find local roofing companies services. It’s essential to choose a roofing companies or contractors that you can trust to provide high-quality work.

Roof insurance is a vital component of any homeowner’s insurance policy. It protects you from the financial burden of repairing or replacing your roof if it is damaged by natural disasters, such as wind, hail, or lightning, or by man-made causes, such as vandalism or fire. This article will walk you through roof and home insurance scenarios and FAQs that would benefit you if and when you need roofing companies services to your home.

How does the deductible work on a roof claim?

When filing a roof insurance claim, it’s important to understand how the deductible works. The deductible is the amount of money that the policyholder is responsible for paying out of pocket to roofing companies before the insurance company will cover the remaining costs. For example, if a policy has a $500 deductible and the total cost of the roof repair is $2,000, the policyholder would need to pay the first $500 and the insurance company would cover the remaining $1,500.

It’s important to carefully review the terms of your insurance policy to understand the specifics of your deductible, including the amount and any conditions that may affect it. For example, some policies may have a higher deductible for certain types of damage or for certain types of roofs.

If you’re considering filing a roof insurance claim, it’s a good idea to get estimates from multiple roofing companies to get a sense of the potential cost of the repairs. This can help you understand the impact of your deductible on the overall cost of the repairs and help you make an informed decision about whether or not to file a claim.

What happens if the damage is cheaper than the deductible?

If the cost of repairing the damage to your roof is less than your deductible, it may not make financial sense to file a claim with your insurance company. In this case, you would be responsible for paying for the repair out of pocket.

However, it’s important to carefully consider all of your options before making a decision. Even if the repair cost is less than your deductible, it’s still possible that filing a claim could be beneficial in the long run. For example, if you have a high deductible and a history of multiple small claims, filing a claim for a minor repair could help to prevent your insurance premiums from increasing.

If you’re not sure whether or not to file a claim, it can be helpful to talk to your insurance agent or a trusted professional in the roofing companies industry. They can help you to understand the potential costs and benefits of filing a claim and assist you in making an informed decision.

Overall, it’s important to carefully assess the situation and consider all of your options before deciding whether or not to file a claim for roof damage.

Can roofing companies negotiate a deductible?

A deductible is the amount of money that a policyholder must pay out of pocket before their insurance coverage kicks in. Many insurance policies, including health, auto, and homeowners insurance, have deductibles as a way to lower premiums and encourage policyholders to be more responsible for their own expenses.

But can roofing companies negotiate a deductible? The short answer is yes, you can often negotiate the deductible on your insurance policy, but not on your claim. However, it’s important to keep in mind that the lower the deductible, the higher the premium will be. So if you want to lower your deductible, you may need to pay a higher monthly or annual premium.

It’s also important to consider your personal financial situation when negotiating a deductible. If you can afford a higher deductible, it may make sense to pay a lower premium. On the other hand, if you have a lower income or less financial flexibility, it may be better to pay a higher premium in exchange for a lower deductible.

Ultimately, whether you can negotiate a deductible and how much you can negotiate will depend on the specific insurance company and policy you have. It’s always a good idea to shop around and compare quotes from multiple insurance providers before making a decision.

Will I ever have to pay more than my deductible?

As a homeowner, you may have wondered if you will ever have to pay more than your deductible when it comes to roofing companies repairs or replacements. The short answer is: it depends.

If your roof damage is minor and can be repaired for an amount less than your deductible, then you will only have to pay the deductible. However, if the damage is more extensive and requires a full roof replacement, you may have to pay more than your deductible. This is because the cost of a new roof can be significantly higher than the deductible amount.

It’s important to note that having a higher deductible can also save you money on your homeowner’s insurance premiums. So, it’s a good idea to weigh the pros and cons of a higher deductible before making a decision.

Ultimately, whether or not you will have to pay more than your deductible for roofing companies repairs or replacements depends on the extent of the damage and the cost of repairs. It’s always a good idea to consult with a roofing companies professional to assess the damage and provide an estimate for repairs.

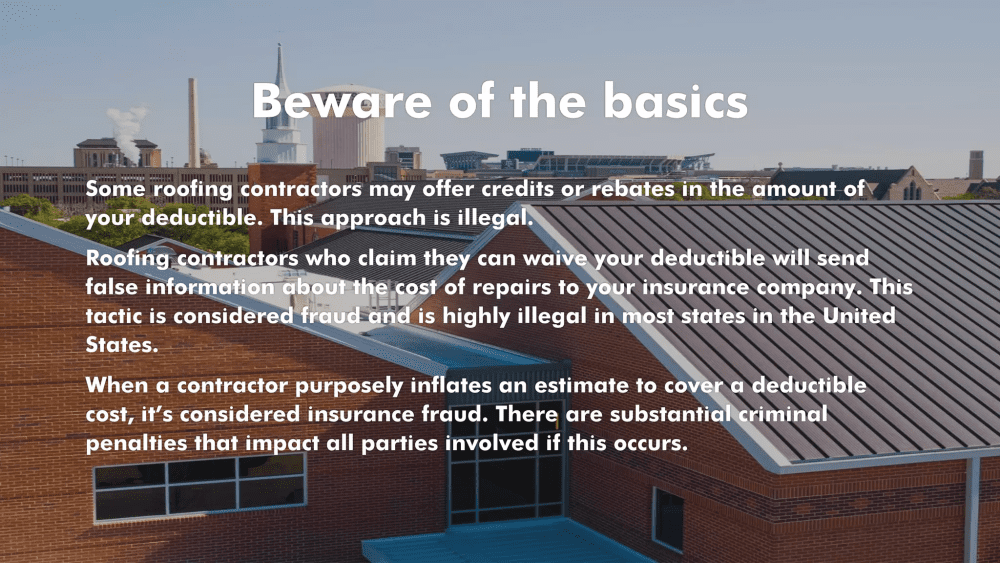

Is it OK for a contractor to waive my deductible?

If you have experienced damage in your home, you may be seeking a roofing companies contractor to handle the repairs. You may come across contractors who claim that they will “waive” or “pay” your insurance deductible. These statements may seem appealing, as it means you would not have to pay the deductible out of pocket, which can often be a significant amount of money. However, it is important to be aware that these statements are not legal.

Contrary to what roofing companies may claim, it is not legal for them to absorb or waive your deductible. The contractor needs to be paid for their services, and in many cases, the deductible is their entire profit for the job. In order to recoup this cost, they may try to mislead the insurance company about the true cost of the repairs.

It is important to be cautious when hiring a roofing companies and to carefully review any agreements or contracts before signing. It is also a good idea to check with your insurance company to understand their policies and procedures for deductible payments.

Are you in need of residential storm damage roofing companies services or products?

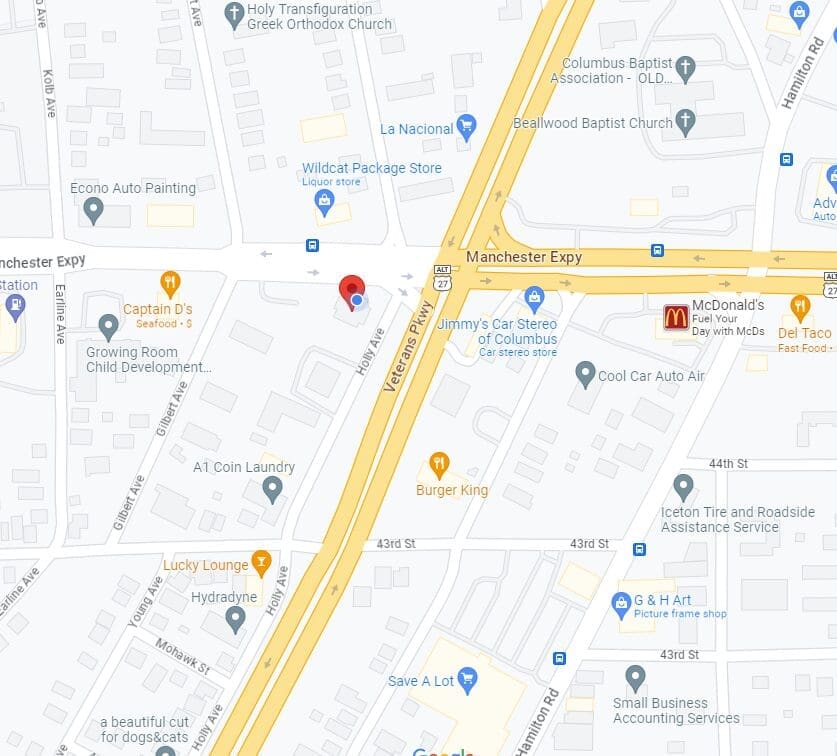

Alliance Specialty Contractor, Inc. is a GAF Certified Contractor and a Full Service, Veteran Owned, Roofing companies near you that specializes in handling Storm Damage and Insurance Claims! We are the #1 source for all your roofing needs and your full-service roofing company that specializes in Storm damage roof replacement for all properties. We offer roof financing for your roof replacement.

You can count on our highly skilled team to provide fast and reliable free roofing inspections. We deal directly with insurance to ensure you receive the coverage you deserve and provide the best products from GAF. Are you in the Pittsview, Seale, Salem, La Grange, Shiloh, Phenix City, Auburn, Opelika, Columbus, Midland, Ft. Mitchell, Salem, Fortson, or Smiths Station?

Contact Us Today!

(877) STORM-11