Navigating Roofing Solutions

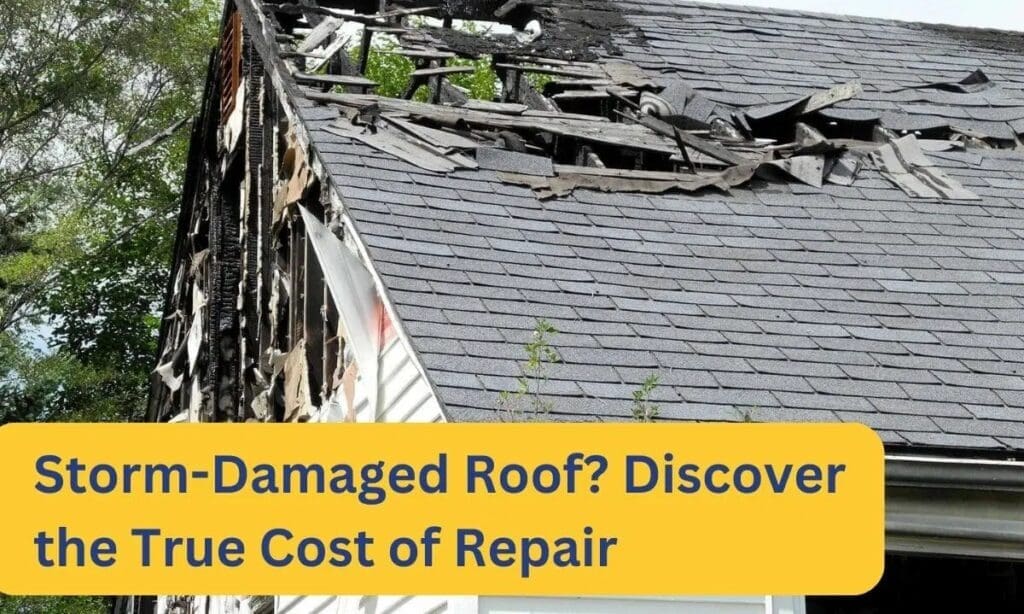

Tornadoes are natural disasters that can wreak havoc on homes and communities. When a tornado strikes, one of the most vulnerable parts of a house is the roof.

It’s crucial for homeowners to understand the intricacies of tornado claims and how reputable roofing companies like Alliance Specialty Contractor can play a pivotal role in restoring safety and normalcy to their lives.

Roofing Companies: Your Trusted Partners in Tornado Claims

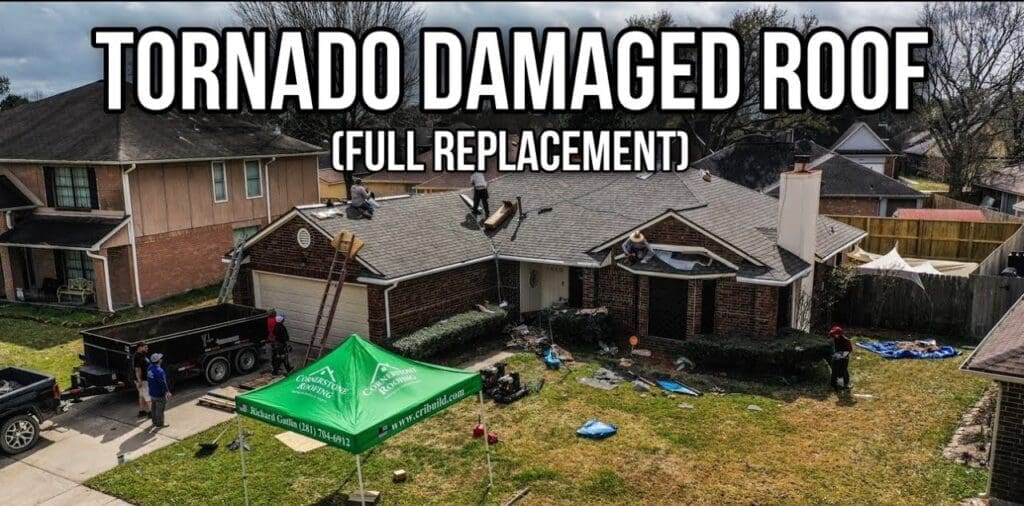

Roofing companies are the linchpin of tornado claims, serving as trusted partners in the aftermath of these devastating events. They are essential in ensuring that homeowners receive prompt and professional assistance to assess and repair tornado damage.

Tornado Damage Assessment by Roofing Companies

Roofing companies excel in conducting thorough tornado damage assessments. These assessments are critical in determining the extent of damage to a roof and the subsequent repair or replacement needed. Here’s how roofing companies contribute to this vital process:

- Swift Response:

- Reputable roofing companies like Alliance Specialty Contractor prioritize rapid response to tornado damage calls. This timely response can prevent further damage caused by exposure to the elements.

- Expert Inspection:

- Roofing experts perform meticulous inspections, identifying all tornado-related damage, including missing shingles, structural issues, and potential leaks.

- Accurate Estimates:

- Roofing companies provide homeowners with accurate estimates for repairs or roof replacements. These estimates are crucial for insurance claims.

- Documentation:

- Roofing experts document all findings, providing homeowners with comprehensive reports to support their insurance claims.

Navigating Insurance Claims for Tornado Damage

Navigating insurance claims in the wake of a tornado can be complex. Homeowners often find themselves facing a multitude of challenges, but roofing companies can simplify the process and ensure a successful outcome:

- Insurance Claim Assistance:

- Reputable roofing companies assist homeowners in navigating the insurance claim process. They are well-versed in the intricacies of insurance policies and can help homeowners submit accurate claims.

- Advocacy:

- Roofing experts act as advocates for homeowners, ensuring that insurance adjusters assess all tornado-related damage correctly.

- Timely Repairs:

- Roofing companies work closely with insurance providers to expedite repairs or replacements, minimizing the disruption to homeowners’ lives.

Choosing the Right Roofing Company for Tornado Claims

Selecting the right roofing company is pivotal when dealing with tornado claims. Homeowners should consider several factors to ensure they partner with a reputable and capable roofing company:

- Local Presence:

- Opt for roofing companies with a strong local presence and a proven track record of assisting homeowners in your area.

- Licensing and Credentials:

- Verify that the roofing company holds all necessary licenses and certifications, ensuring compliance with local regulations.

- Experience:

- Choose a roofing company with extensive experience in handling tornado claims, as they understand the nuances of this specific type of damage.

- References and Reviews:

- Check references and read online reviews to gauge the company’s reputation and customer satisfaction levels.

Roofing Companies: The Cornerstone of Tornado Recovery

In the aftermath of a tornado, roofing companies become the cornerstone of recovery efforts. Their expertise, prompt response, and commitment to quality are instrumental in restoring homes to their pre-tornado condition.

Conclusion: Tornado Claims Made Easier with Roofing Companies

In conclusion, tornado claims can be a challenging process for homeowners. However, partnering with reputable roofing companies like Alliance Specialty Contractor can significantly ease the burden. These companies play a crucial role in assessing tornado damage, guiding homeowners through insurance claims, and ultimately restoring their roofs and homes.

We hope this page serves as a valuable resource for homeowners affected by tornadoes. To learn more or to seek assistance with tornado claims, please don’t hesitate to contact Alliance Specialty Contractor. We are here to support you on your path to recovery and help rebuild your home’s safety and security.

Tornado Insurance Claims

Tornado claims are a type of insurance claim that homeowners make when their property has been damaged by a tornado. Each year, thousands of tornado claims are made across the United States, particularly in regions where tornadoes are more likely to occur. The exact number of tornado claims made each year varies depending on the severity of the tornadoes and the region of the country. However, it is important to note that tornadoes are one of the most destructive and costly weather events.

According to the National Oceanic and Atmospheric Administration (NOAA), the United States averages around 1,200 tornadoes per year. The Insurance Information Institute (III) states that tornadoes are the leading cause of severe thunderstorm losses in the United States, with the average annual insured loss from tornadoes being around $2 billion.

The number of tornado claims made each year can also be influenced by factors such as population density, the number of homes in an area, and the overall level of development in an area. For example, states located in the “Tornado Alley” such as Texas, Oklahoma, Kansas, Nebraska, and South Dakota have a higher number of tornado claims as compared to states with less population density.

Furthermore, the number of claims made also depends on the severity of the tornado. The stronger the tornado, the more likely it is to cause damage to property, and the more claims that will be made. The larger the storm, the more extensive the damage will be, leading to more claims. For example, an EF5 tornado will cause more damage than an EF1 tornado.

The cost of tornado claims also varies depending on the type of property that was damaged. For example, tornado damage to a roof can be more expensive to repair than tornado damage to a car. In addition, the cost of repairs can vary depending on the type of roofing material, the age of the roof, and the extent of the damage. Buildings and homes with older or weaker structures may be more susceptible to tornado damage and therefore, more costly to repair. The cost of rebuilding a home or office can be very expensive and can vary depending on the location, type of construction, and the level of damage.

It’s worth noting that the tornado claims can also be affected by other factors such as construction codes and building regulations. In areas where building codes are stricter and buildings are built to withstand higher winds, the number of tornado claims may be lower.

Another important factor is the insurance coverage that homeowners have. Many homeowners may not have adequate insurance coverage to cover the full cost of damages caused by a tornado, and this can lead to a higher number of claims. It’s essential for homeowners to review their insurance coverage regularly to ensure that it is sufficient to cover the potential damages caused by a tornado.

In conclusion, the number of tornado claims made each year varies depending on the severity of the tornadoes and the region of the country. According to the Insurance Information Institute (III) states that tornadoes are the leading cause of severe thunderstorm losses in the United States, with the average annual insured loss from tornadoes being around $2 billion. The number of claims made also depends on factors such as population density, the number of homes in an area, and the overall level of development in an area, as well as the severity and size of the tornado and the type of property that was damaged.

Additionally, the location of the property, building codes and regulations also play a role in the number of tornado claims made each year. Regularly inspecting and maintaining the property and reviewing insurance coverage can help to minimize the damage caused by tornadoes and reduce the number of tornado claims made each year.

Are you in need of residential storm damage roofing services or products?

Alliance Specialty Contractor, Inc. is a GAF and Tamko Certified Contractor and a Full Service, Veteran Owned, Roofing companies near you that specializes in handling Storm Damage and Insurance Claims! We are the #1 source for all your roofing needs and your full-service roofing company that specializes in Storm damage roof replacement for all properties. We offer roof financing for your roof replacement.

You can count on our highly skilled team to provide fast and reliable free roofing inspections. We deal directly with insurance to ensure you receive the coverage you deserve and provide the best products from GAF. Are you in the Pittsview, Seale, Salem, La Grange, Shiloh, Phenix City, Auburn, Opelika, Columbus, Midland, Ft. Mitchell, Salem, Fortson, or Smiths Station?

Contact Us Today!

(877) STORM-11