Will Your Insurance Cover Storm Damage To Your Roof?

Your typical all-perils homeowner’s insurance policy will cover your roof and the cost of replacement if a storm damages it. This is the good news, but you should note you’re covered only if the roof damage results from a sudden accident or act of God. Damages from normal wear and tear or an old roofing system are usually not eligible for reimbursement. Many Roofing Companies know that insurance companies typically categorize these damages under the general maintenance responsibility of the property owner.

Understanding What Constitutes an Act of God

For insurance companies, an act of God is generally any unpredictable or unpreventable incident. It typically describes an event which:

- Is not triggered by a person

- Cannot be prepared for, predicted, or anticipated

- Occurs as a direct consequence of natural causes

- Cannot be humanly prevented or controlled

Natural catastrophes and hazards such as storms, hurricanes, earthquakes, floods, tornadoes, and lightning are considered acts of God. In many instances, your insurer will consider an event an act of God based on your home’s geographical location and how your policy is written.

In other words, your homeowner’s insurance might not cover certain acts of God depending on where you live. For example, some parts of the country have never experienced hurricanes; therefore, it wouldn’t be reasonable to protect against them. Again, depending on your policy writing, some insurance policies provide coverage for hail, wind, and lightning but exclude floods and earthquakes even though they would be considered acts of God.

How Roof Coverage Works

The roof is arguably the most exposed component of your home to the elements. It is constantly exposed to the weight of heavy hail and snow or ice storms in winter and scorching sunshine in summer. Tornadoes and cyclones are also frequent problems along the shorelines. In tropical climates, your roof can suffer potential damage from gales and hurricane-force winds.

Other than direct storm damage, Mother Nature can also trigger various sorts of havoc. For example, a violent windstorm can topple a tree onto your roof and cause massive damage. There may also be wildfires or accidents of objects crashing down on your roof from above.

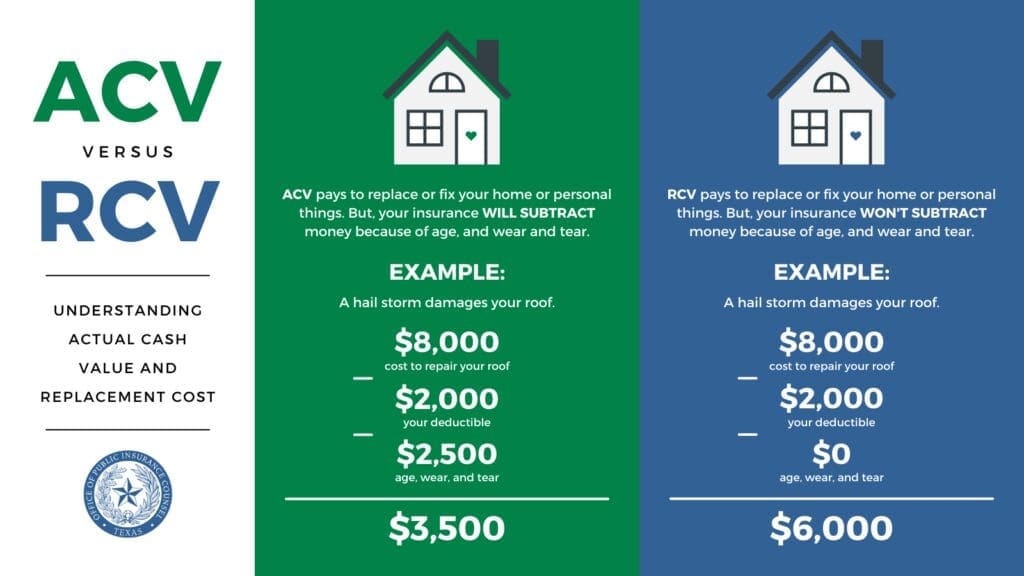

The dwelling coverage section of your homeowner’s insurance policy protects you from such perils. Roof damage and destruction qualify you for a total or partial reimbursement for the cost of replacing your roof. However, coverage is often curtailed for roofing companies systems over 20 years old. Your insurer may only cover roofs for their actual cash value and not their current replacement cost.

Additionally, your roof must be determined to have been in perfect shape before the storm. This is why it’s essential to stay up to date with periodic free roofing inspection and maintenance to keep your coverage valid.

Repair Vs. Replacement Based On Your Deductible

Of course, you’ll have to pay your policy deductible before your insurance coverage kicks in. If your policy is written in certain high-risk areas, it can impose a higher deductible for roof damages ensuing from hurricanes or hailstorms. Your roofing companies will assess your roof and issue an estimate of what it will cost to restore your roof.

Depending on the extent of storm damage, your roofing companies may recommend repairs of the damaged sections of your roof or a total replacement. If only one area of your roof is damaged, your roofing companies will compare the cost of restoration against your policy deductible. As a general rule of thumb, only file claims for damages that exceed your deductible.

Always Work with a Reliable Local Roofer

Finally, working with a reliable and local roofing companies to fix your roof after storm damage can relieve some stress. A reputable roofing companies should be happy to work with your insurance provider to negotiate appropriate compensation. Besides, they should not demand full payment upfront. Once your insurance claim is approved, your roofer should only ask you to pay your policy deductible as required by law and begin the restoration process.

Overall, your homeowner’s insurance should cover the cost of repairing or replacing your roof after storm damage. If the damage is from a poorly installed roof, it’s a warranty issue.

Whenever a storm damages your roof, you can depend on our knowledgeable and experienced roofing companies specialists at fortheclaim.com. We can help you through the insurance claim process and have your roof fixed as quickly as possible to avert further water damage. Our certified roofing companies technicians can also provide roof inspection and preventive maintenance services to ensure your roof stands up to storms. Contact us today to discuss your needs or schedule a free assessment in the Southern New Hampshire and Northern Massachusetts areas.