Finding The Best Storm Claim Roofing Companies Near You

The type of material the roof is made of will determine the outlook and how long it will last before being replaced by the roofing companies. So it’s good to explore various options to choose the best roofing companies.

When you discover that a series of damages has been made to your roof, it’s best to know if the roof is due for replacement and act accordingly. But most importantly, it is to find the best roofing companies to help you handle the project.

A reputable roofing companies that knows its onions will help you inspect the roof and identify the problem and proffer a solution. They must have built a reputation over the years as a roofing companies with an excellent portfolio. If you have already found a trusted roofer near you, you can discuss the problem, and they will give you the best advice on whether to repair or replace it.

Is Storm Damage to Roof an Act of God

In the insurance world, the word “act of God” is used to describe incidents and scenarios that are beyond human control. As roofing companies know, these incidents cannot be predicted or prevented by humans. Events like floods, hurricanes, earthquakes, and storms are natural catastrophes that cannot be avoided and are therefore categorized as acts of God.

If you have insurance coverage for unpredictable natural disasters, the insurance company will determine what caused the damage. Usually, storm damage caused by rain or wind is covered by the insurance company.

Make sure you read the company’s policy to know the acts of God that are covered and the ones that are not. So when the storm destroys your roof, you should call your insurance company to lay an insurance claim. After the evaluation is done to ensure that the damage is an act of God, they can then proceed to cover the replacement costs with your roofing companies.

How Much Damage Does a Roof Need to Be Replaced?

If the level of damage your roof has is a minor situation like leaks or minor wind damage, then repair is what is needed. But if you notice some of these cases outlined below, your roof needs to be replaced.

- The shingles on the roof are peeling off, which usually indicates severe damage.

- The roof is aging and is nearing or has reached the end of the recommended life span.

- If there are significant damages caused by a tree falling on the roof of your home that has resulted in deep leaks, consider a replacement.

- If you constantly make constant repairs over time and the problem persists, it’s time to change it completely.

- If the roof has problems with its structure, like the plywood of the roof deck sagging in between the rafters, replace it.

Significant damages like these on the roof call for replacement, so all you need do is get a roofing companies to look at the roof and give you the best solution.

Who is Liable Roofing Companies For Storm Damage to Property

Having to deal with damages on the property can be an overwhelming and expensive experience. If there is anything that the owner would be thinking about is how to repair the damage and, most importantly, who will handle the payment aspect. Knowing who is responsible for storm damage to your property will help you understand who to hold liable for the incident.

If a storm damages your property, then it’s no fault of yours. This situation is simply a natural catastrophe referred to as an “act of God, so your insurance company handles that.

If this kind of incident happens, you can call on your insurer as soon as the damage occurs to claim homeowner insurance benefits. You can take pictures and make videos as proof as well.

But If the damage was caused by your neighbor’s tree falling on your roof, then it’s the responsibility of their insurance company to cover the expenses.

How do Storm Damage Insurance Claims Work?

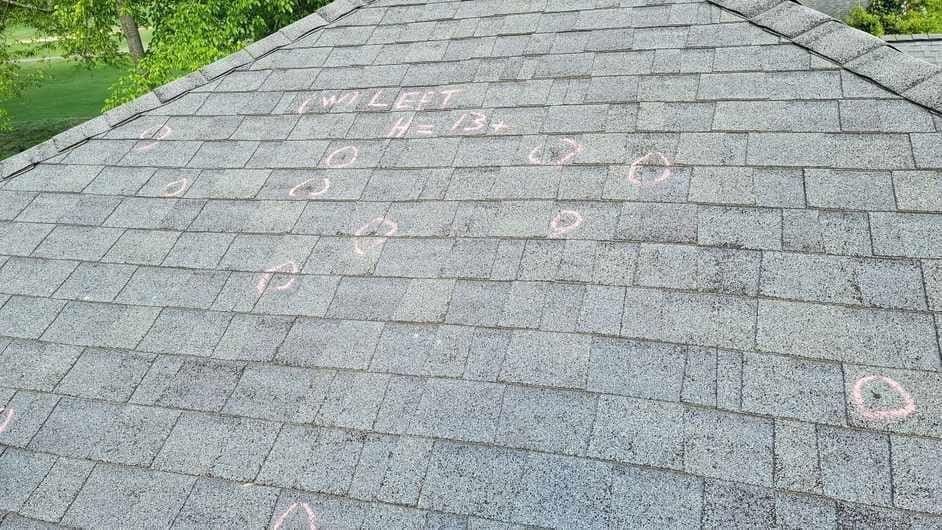

Before filing an insurance claim, it’s essential to inspect the roof to determine the extent of the damage. This should be done immediately after the incident because these insurance companies work with time, so you make sure you meet the deadline.

The first thing to do is to contact your insurer, and this should be done in time. Some insurance companies might request picture documentation that shows the damages done. But in recent times, insurance companies have not been requesting this information.

Your insurer will recommend the best process for you to follow to get your home back in shape. Then go ahead to see what is covered in your insurance policy.

The insurance company will appoint an adjuster to oversee the damaged property and make an estimate for the repair. Make sure to keep in touch with them for further instructions.

What Not to Say to Home Insurance Adjuster

The adjuster sent to you might try to play a fast one on you by asking you some trick questions. Below are some of the things you should never say:

- Usually, the adjuster would like to look for ways to make the insurance company escape paying for the damages. Don’t ever admit fault or say anything that jeopardizes your chance of claiming your insurance.

- Give a concise narration of the incident, and be open as much as possible when talking. Don’t say one thing, and the next minute, you are saying something else.

- Don’t ever agree to make a recorded statement to the adjuster. You can politely decline the invitation. It’s a wise decision because the information might be used against you tomorrow.

- Don’t say yes to the first offer. Most times, these insurance companies provide a standard recommendation first before making a second offer, hoping you accept it.

Conclusion

The best roofing companies services are not always the most expensive. First is to understand the level of damage done to your roof to know the plan to get your property back. If you are looking for the best roofing companies, compare a couple of contractors who have done an excellent job with others in your area. If you have a home insurance policy, you can contact them for an insurance claim. And you will get a reimbursement for the money spent replacing the roof.

Roofing storm claims are a type of insurance claim that homeowners make when their roof has been damaged by a storm, such as a hail, wind or tornado. Each year, thousands of roofing storm claims are made across the United States. The exact number of roofing storm claims made each year varies depending on the severity of the storms and the region of the country. However, it is important to note that storms are one of the most common causes of property damage and it is considered one of the most destructive weather events.

According to the National Oceanic and Atmospheric Administration (NOAA), the United States averages around 12,000 thunderstorms per year, with about 1,800 of those producing hail, wind or tornadoes. The Insurance Information Institute (III) states that hail, wind, and tornadoes are the leading causes of severe thunderstorm losses in the United States, with the average annual insured loss from these storms being around $11 billion.

The number of roofing storm claims made each year can also be influenced by factors such as population density, the number of homes in an area, and the overall level of development in an area. For example, states with high population density such as Texas, Florida, and California, have a higher number of roofing storm claims as compared to states with less population density.

Furthermore, the number of claims made also depends on the severity of the storm. The stronger the winds, the larger the hail or the more intense the tornado, the more likely it is to cause damage to the roof and the more claims that will be made. The larger the storm, the more extensive the damage will be, leading to more claims. For example, a hailstorm that produces golf ball-sized hail will cause more damage than a hailstorm that produces pea-sized hail.

The cost of roofing storm claims also varies depending on the type of roofing material, the age of the roof, and the extent of the damage. Buildings and homes with older or weaker roofing structures may be more susceptible to storm damage and therefore, more costly to repair. The cost of rebuilding a roof can be very expensive and can vary depending on the location, type of construction, and the level of damage.

It’s worth noting that the roofing storm claims can also be affected by other factors such as construction codes and building regulations. In areas where building codes are stricter, and buildings are built to withstand higher winds and hail, the number of roofing storm claims may be lower.

Another important factor is the insurance coverage that homeowners have. Many homeowners may not have adequate insurance coverage to cover the full cost of damages caused by a storm, and this can lead to a higher number of claims. It’s essential for homeowners to review their insurance coverage regularly to ensure that it is sufficient to cover the potential damages caused by a storm. This includes not only the cost of repairing the roof but also the cost of any interior damages caused by water leaks.

In addition, it is important for homeowners to have regular roof inspections and maintenance to identify and address any potential issues before they become severe. This can help to ensure that the homeowner receives the coverage they are entitled to, and that the repairs are done correctly. A proper maintenance can also help to prolong the life of the roof, reducing the need for costly repairs and replacements.

Another important aspect is to choose a professional and reliable roofing contractor to handle the repairs or replacement. Hiring a contractor that is not licensed, insured, or experienced can lead to poor quality work, delays, and additional costs.

In conclusion, the number of roofing storm claims made each year varies depending on the severity of the storms and the region of the country. According to the Insurance Information Institute (III) states that hail, wind, and tornadoes are the leading causes of severe thunderstorm losses in the United States, with the average annual insured loss from these storms being around $11 billion.

The number of claims made also depends on factors such as population density, the number of homes in an area, and the overall level of development in an area, as well as the severity and size of the storm and the type of roofing material and roofing structure. Additionally, the location of the property, building codes and regulations also play a role in the number of roofing storm claims made each year.

Regularly inspecting, maintaining the property, reviewing insurance coverage and choosing a reliable roofing contractor can help to minimize the damage caused by storms and reduce the number of roofing storm claims made each year.