In the heart of Central Texas, residents faced the wrath of severe hailstorms in both April and September. These weather events, while awe-inspiring, left behind a trail of destruction. Among the affected was Elizabeth Edge from Pflugerville, Texas, who discovered that navigating insurance claims for hail damage could be more challenging than expected.

In April, her home’s roof bore the brunt of the hailstorm’s fury. Eager to repair the damage, Elizabeth promptly filed a claim with Allstate in June. However, her experience took an unexpected turn when an adjuster assessed the damage. According to Edge, the adjuster deemed the damage minimal, suggesting that only a small portion of her roof required replacement.

“They just said there wasn’t enough damage, that they didn’t think the damage that was done was caused by hail,” Edge recalled.

Determined to address the situation, Elizabeth sought a second opinion from a roofing company. Their assessment contradicted Allstate’s findings; they identified significant damage that necessitated the replacement of the entire roof. The roofing company conveyed their findings to Allstate.

Unfortunately, Elizabeth’s journey through the insurance process was far from smooth. Additional complications arose when the September storms unleashed even more havoc, causing further damage to her home. Despite the evident need for repairs, Allstate ultimately denied her claim.

“Five months later, after the second storm, with more damage, they’ve decided to deny it,” lamented Edge.

The denial has left Elizabeth at a crossroads. As is customary with insurance claims, the responsibility for payment falls on the insurance company.

“I don’t think it’s good customer service from Allstate. I just think they need to stand behind their insurance policy and pay what is due,” she expressed. “I plan to do whatever I need to get my roof repaired by the insurance company.”

In light of Elizabeth Edge’s situation, KVUE reached out to Allstate for a response. A spokesperson acknowledged the concerns raised and confirmed that they are investigating the matter.

For individuals facing difficulties with their insurance claims, the Texas Department of Insurance offers a roadmap:

Step 1: Talk to the insurance company

It is advised to initially engage in a discussion with your insurance company or agent. If there is a dispute regarding the adjuster’s estimate, communicate the reasons for your disagreement. Sometimes, the company may revise the estimate upon receiving additional information or discovering overlooked details. Support your case with any relevant documents, such as a contractor’s estimate for the repairs. If disagreements persist, you have the option to challenge the insurance company’s decision.

Step 2: Ask for an appraisal or hire a public adjuster

Many insurance policies include an appraisal process to resolve disputes. In this process, both you and the insurance company appoint an appraiser, and together, they choose a third appraiser who acts as an umpire. Costs related to appraisers are typically divided between you and the insurance company. The appraisers assess the claim and the extent of the damage, and if their estimates differ, the umpire makes the final decision.

Alternatively, some people choose to hire public insurance adjusters to assist in negotiating claims with insurance companies. Public adjusters work on your behalf, not the insurance company’s, and their services come at a cost, usually a percentage of the claim payment. Before engaging a public adjuster, ensure they hold a TDI license.

Step 3: File a complaint

The Texas Department of Insurance can help with complaints against insurance companies, agents, or adjusters that fall under their regulation. However, they do not handle complaints against service providers like contractors or roofers.

In conclusion, navigating insurance claims for hail damage can be a complex and challenging process. The story of Elizabeth Edge serves as a reminder of the importance of understanding the insurance claims process and seeking assistance when disputes arise.

Are you in need of residential storm damage roofing services or products?

Alliance Specialty Contractor, Inc. is a GAF Certified Contractor and a Full Service, Veteran Owned, Roofing companies near you that specializes in handling Storm Damage and Insurance Claims! We are the #1 source for all your roofing needs and your full-service roofing company that specializes in Storm damage roof replacement for all properties. We offer roof financing for your roof replacement.

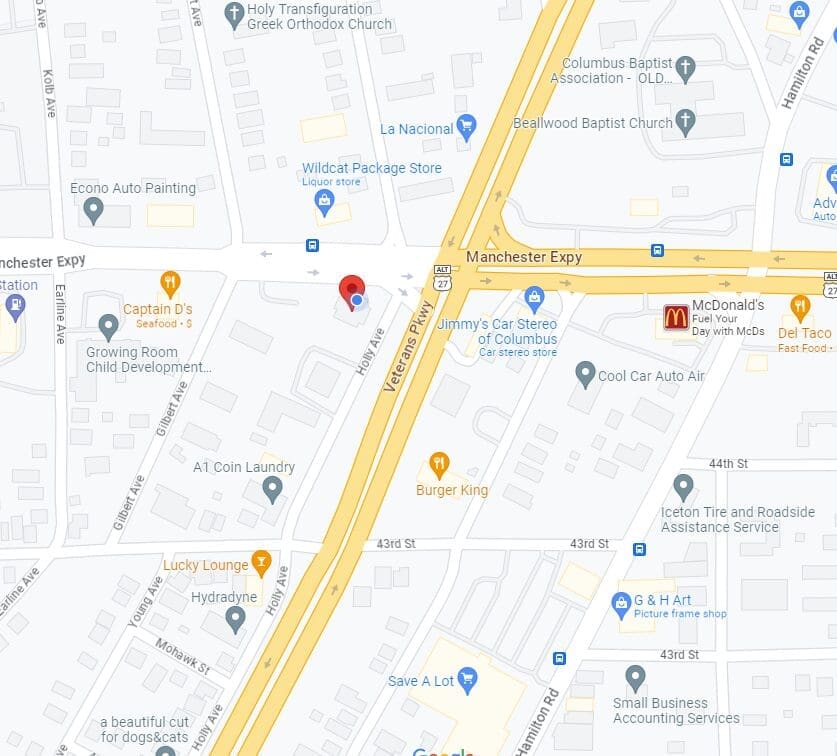

You can count on our highly skilled team to provide fast and reliable free roofing inspections. We deal directly with insurance to ensure you receive the coverage you deserve and provide the best products from GAF. Are you in the Pittsview, Seale, Salem, La Grange, Shiloh, Phenix City, Auburn, Opelika, Columbus, Midland, Ft. Mitchell, Salem, Fortson, or Smiths Station?

Contact Us Today!

(877) STORM-11

Leave a Reply